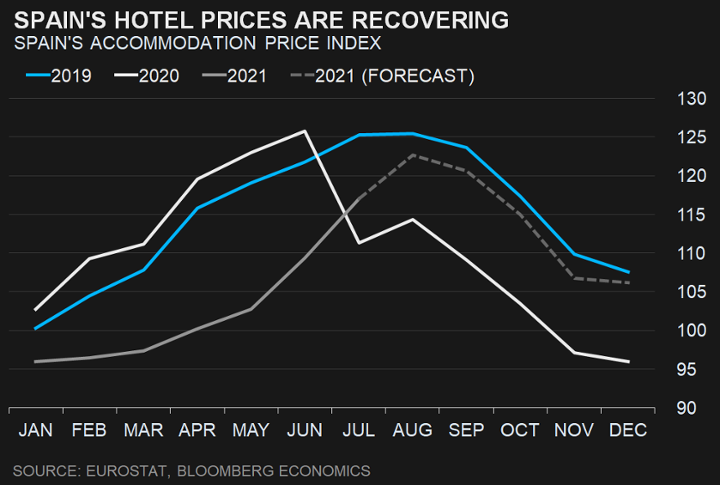

Spain’s inflation rebounded strongly in July, as the very unusual drop in hotel prices recorded at the same time last year was not repeated. We forecast some upward pressure from energy costs and a further recovery in hotel prices will drive the headline rate to 3.1% from 2.9%. As the pandemic hammered Spain’s tourism industry, prices for accommodation fell sharply in July 2020 and remained around 10% below levels seen in the same month of 2019 for most of last year. But with travelers returning in greater numbers, prices rebounded last month to 6% below their July 2019 level, contributing 0.4 ppt to the rebound in inflation. We expect they will continue to recover and support inflation in the coming months, albeit at a slower pace. We also anticipate some increase in both electricity costs and fuel prices to put further upward pressure on headline inflation in August.

Inflation in Germany jumped to 3.1% in July from 2.1%, largely reflecting the impact of the temporary cut in sales tax that lowered prices in July to December last year. We expect both the core and headline readings to increase again this month, to 3.4% and 2.2%, respectively. The increase in inflation for July was broad based, reflecting the impact of lower prices last year because of the temporary reduction in VAT, when the standard rate was lowered to 16% from 19% while the reduced rate fell to 5% from 7%. This source of upward pressure is likely to intensify slightly in the coming months, before unwinding in January. Package holiday prices had fallen by more than usual in August last year. We expect a more modest decline this year. Combined with the statistical effects from a lower weighting on package holidays in the HICP basket this year, this points to the category pushing up both the headline and the core reading in August. This effect is likely to intensify in September.

The tapering of a government tax break on purchases is taking some of the froth out of the U.K. housing market. Base effects also mean the annual rate is likely to drop below 10% in August after prices surged this time last year. Still, the shift in behavior caused by the pandemic will mean demand for more spacious homes continues. That will keep activity simmering this year given the low level of supply.