Suzano sets new price for BEK pulp in Europe at $750/tn. According to industry sources, Suzano is informing its customers in Europe & North America of a price increase effective with Jannuary shipments. Suzano targets the price of $750/tn in Europe & $970/tn in North America (before commercial discounts). This is the second attempt to increase prices in Europe this year, following the unsuccessfully effort made in May by LatAm BEK producers to rise prices by $30/tn. At that time, weakness in global demand (especially in P&W) & uncertainty surrounding COVID-19prevented from any price hike. On the contrary, Suzano (#1 global BEK producer with c.30% market share) has already implemented price increases in China in the past months (followed by other LatAm producers like CMPC & Klabin).

Growing momentum in market pulp. Pulp price is at its lowest level on the L10Y, on the longest downturn cycle of its recent history (L23M) backed by soft demand (especially in P&W. which represents c.25% global output) & (somehow) excess capacity (+c.8m/tn in HW from 2013-19, which compares with total output of c.37m/tn). However, we believe this prices levels are not sustainable (as probably c.30% of the industry is now loss making), and we believe producers are starting to increase prices (China, and now a new attempt in Europe) as inventories are consolidating in current (high) levels, global demand recovery (as vaccine gains traction) & limited addictional capacity expected in the coming quarters.

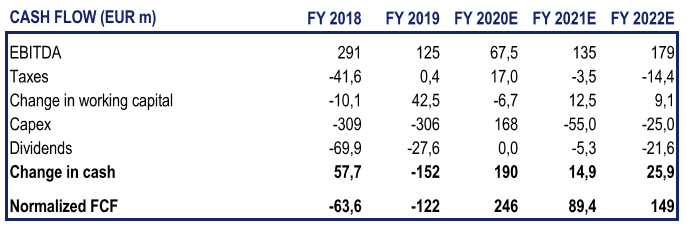

We reiterate our Buy rating. If the price hike finally materialises, this would imply the first increase in Europe in more than 2Y. We would expect the other players to follow the move, as recently seen in China, and announce price increases across the board in Europe. We believe that Ence has made a strong step forward to crystallise value & dispel B/S concerns on the recent repositioning of its Energy business (valuing the business between c.€0.8-1.0bn depending on different considerations of its associated earn outs). The question now is how much will be the market value the Pulp business in the current market conditions, in a context of “digestion” of high inventories & weak supply/demand equilibrium (as always in any case). We think that the pulp cycle is bottoming out and that things should improve significantly from 2021. We tent to believe that the market has traditionally been too pessimistic when pulp prices are at low levels, and too optimistic the other way around. Thus, we could see upside focusing on the midpoint as Pulp prices will recover eventually after the longest cycle downturn record (c.25M? or at L10Y lows, which we believe is not sustainable as c.30% of global pulp capacity could be loss-making) and stick to our Buy rating.